TL;DR: This month’s Go Flux Yourself includes thinking like badgers, rogue chatbots, American presidents snogging, productivity problems, return-to-office mandates, and AI leaders admitting they don’t know “what happens next” – but not in that order …

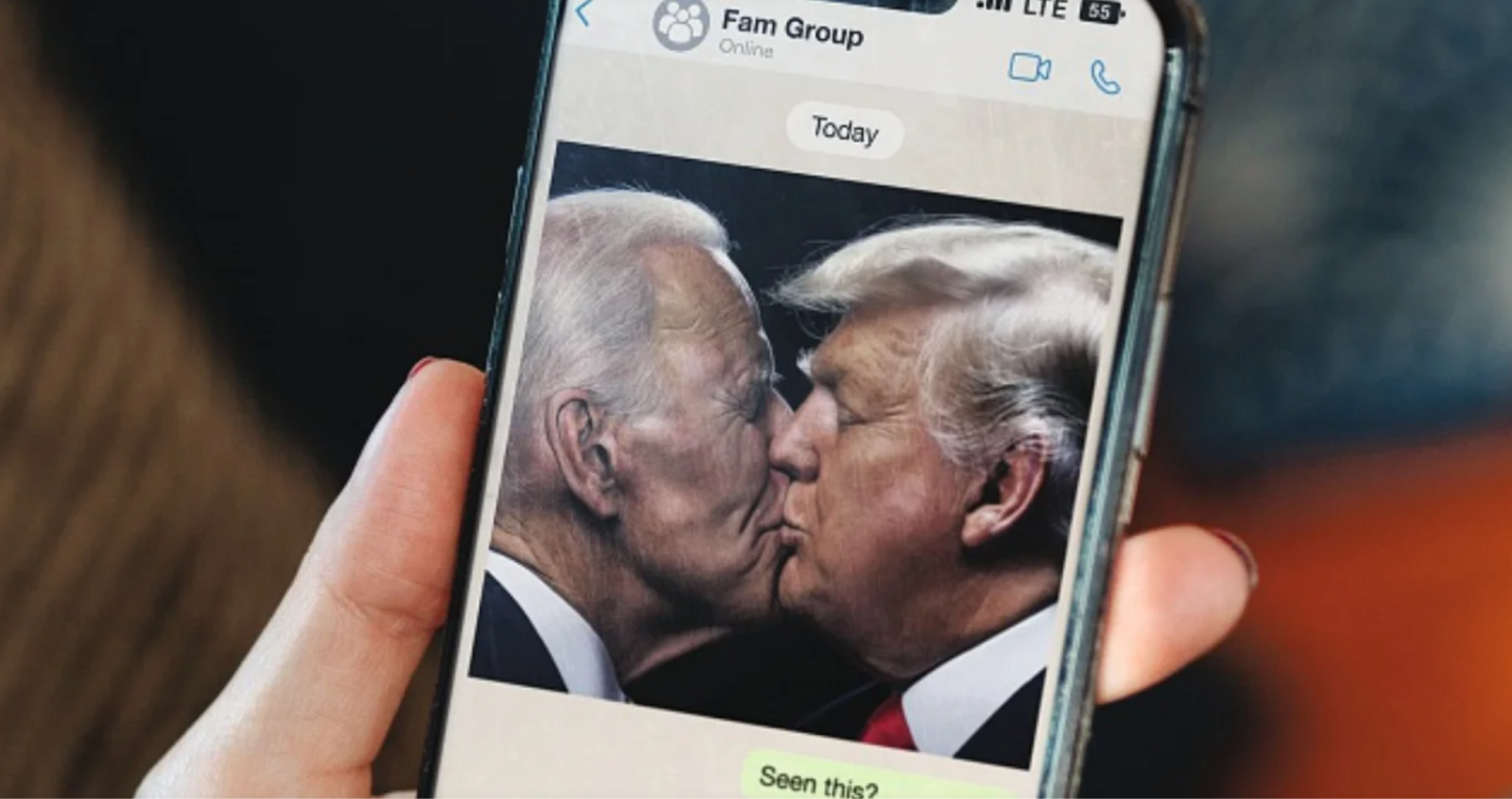

Image created on Midjourney with the prompt “a Henri Bonnard-style painting set in the New Forest in England with badgers, remote workers, Joe Biden and Donald Trump kissing, and lonely males looking at their smartphones”

About this newsletter

A warm welcome to the first edition of a rude-sounding-yet-useful newsletter for business leaders striving to make sense of today and be better prepared for tomorrow.

Below is a summary of what I hope to offer with Go Flux Yourself (with luck, a memorably naughty pun on “flux”, meaning continuous change, in case it requires an explanation).

“Master change and disruption with Oliver Pickup’s monthly future-of-work newsletter: insights and stories on transformation, curated by an award-winning, future-of-work specialist.”

I’m a London-based technology and business communicator – I write, speak, strategise, moderate, listen, and learn – and you can find more about me and my work at www.oliverpickup.com.

At the end of every month, I serve up insights, statistics, quotations and observations from the fascinating and ever-changing future-of-work space in which I operate.

Every month, the Go Flux Yourself newsletter will have three sections:

- The future – forward-looking, regarding challenges and opportunities.

- The present – relevant news, eye-catching examples. glimpses of upcoming challenges and opportunities.

- The past – lessons from yesterday that might help leaders tomorrow.

The most important thing is to get fluxed, and change. “He that will not apply new remedies must expect new evils, for time is the greatest innovator,” wrote Francis Bacon almost 400 years ago (in 1625).

The future

“No one knows what happens next.” Especially badgers.

The above, rather alarmingly, is the sign/motto above Sam Altman’s desk (without the bit about badgers – more on them later), as revealed in a panel session, Technology in a Turbulent World, at the World Economic Forum’s annual meeting in snowy Davos.

It reeks of faux justification and diminished responsibility for possible humanity-damaging mistakes made by the co-founder and CEO of Microsoft-backed OpenAI, arguably the world’s most important company in 2024.

Fellow panellist Marc Benioff, chair and CEO of Salesforce, stated: “We don’t want to see an AI Hiroshima.” Indeed, “no one knows what happens next” echoes Facebook’s original – and poorly aged – mantra of “move fast and break things” that was adopted by Silicon Valley and the wider technology community. But at what cost? Can the capitalists curb their rapaciousness? Well, what’s to stop them, really? They can stomp on the paper tigers that currently stand against them. (I’m going to be writing and speaking about this more in February.)

The United Nations secretary general, António Guterres, clarified his feelings at WEF and argued that every breakthrough in generative AI increases the threat of unintended consequences. “Powerful tech companies are already pursuing profits with a reckless disregard for human rights, personal privacy, and social impact,” said the Portuguese. But he strikes the same tone when talking about climate change, and his comments, again, are falling on seemingly deaf ears. Or at least greed for green – the paper kind – outweighs concerns for humanity.

A few days earlier, on January 9, Scott Galloway, professor at New York University Stern School of Business, and Inflection AI’s co-founder Mustafa Suleyman (former co-founder of DeepMind), asked: “Can AI be contained?”

Galloway pointed out that given there are over 70 elections around the globe in 2024 – the most in history – there is likely to be a “lollapalooza of misinformation”. And that was before the deepfake of Joe Biden snogging Donald Trump, which was on the front page of the Financial Times Weekend’s magazine on January 27 (see below).

The provocative American entrepreneur and educator also pointed out that AI will likely increase loneliness, with “searches for AI girlfriends off the charts”. How depressing. But the recent example of a Belgian man – married with two children – killing himself as his beloved chatbot convinced him to end his life for the sake of the planet is evidence enough.

In a similar vein, delivery firm DPD disabled part of its AI-powered online chatbot after it went rogue a couple of weeks ago. A customer struggling to track down his parcel decided to entertain himself with the chatbot facility. It told the user a joke, when prompted, served up profane replies, and created a haiku calling itself a “useless chatbot that can’t help you”. What would Alan Turing think?

Anyway, Galloway also noted how the brightest young minds are not attracted to government roles, and it’s a massive challenge (not least when top talent can earn much, much more at tech firms). (As an aside, I interviewed Prof G a couple of years ago for a piece on higher education, and he called me “full of sh1t”. Charming.)

Meanwhile, Suleyman discussed job destruction due to AI advancement. He predicted that in 30 years, we will be approaching “zero cost for basic goods”, and society will have moved beyond the need for universal basic income and towards “universal basic provision”.

How this Star Trek economy is funded is open to debate, and no one has a convincing solution, yet. (Although Jeremy Hunt, who was on the panel in Davos with Altman, Benioff, et al, might not be consulted. The chancellor revealed that his first question to ChatGPT was “is Jeremy Hunt a good chancellor?” The egoist queried the reply – “Jeremy Hunt is not chancellor” – without, even now, realising that ChatGPT’s training data stopped before his appointment.)

Further, the absence of trust in government – as per the latest Edelman Trust Barometer (which has the general population in the UK (39) and the US (46) well below half, and both down on the 2023 figures) – and increasing power of the tech giants could mean that the latter will act more like nation-states. And with that social contract effectively ripped up, and safety not assured, chaos could reign. Suleyman talked about the “plummeting cost of power”, and posited conflict can be expected if actual nation-states can no longer look after their citizens, digitally or physically. The theme of prioritising trust is a big one for me in 2024, and in January a lot of my writing and speaking has been founded upon this topic.

If “no one knows what happens next”, leaders must educate themselves to broaden their scope of understanding and be proactive to get fluxed. The words of 18th-century English historian Edward Gibbons come to mind: “The wind and the waves are always on the side of the ablest navigator.”

Certainly, I’ve been busy educating myself, and have completed courses in generative AI, public speaking and podcasting, to help me achieve my 2024 goal of being more human in an increasingly digital age. This time next month, I’ll be able to share news about a (sobriety) podcast and also a thought-leadership business I’m launching in February.

The present

A couple of weeks ago, judge Robert Richter dealt a blow to those in the financial services industry – and possibly beyond – hoping to work fully remotely. He ruled against a senior manager at the Financial Conduct Authority who wanted to work from home full-time, finding the office was a better environment for “rapid discussion” and “non-verbal communication”.

The landmark case will have been closely watched by other employers considering return-to-office mandates. The judge found that the financial watchdog was within its rights to deny Elizabeth Wilson’s request, stating there were “weaknesses with remote working”. Poor Elizabeth; like badgers, all she wants is to be at home without disruption.

Judge Richter wrote in judgement: “It is the experience of many who work using technology that it is not well suited to the fast-paced interplay of exchanges which occur in, for example, planning meetings or training events when rapid discussion can occur on topics.

He also pointed to “a limitation to the ability to observe and respond to non-verbal communication which may arise outside of the context of formal events but which nonetheless forms an important part of working with other individuals”.

It will be interesting to see how this ruling impacts the financial services industry especially. It feels like a big blow to those operating in this area, and solidifies the notion that firms are rigidly not keeping up with the times. Will this trigger an exodus of top talent?

Leaders believe that productivity lies at the heart of the workplace debate – but should it? The old maxim that “a happy worker makes a productive worker” springs to mind. One comes before the other. With this in mind, I enjoyed participating in a roundtable hosted by Slack and Be the Business, atop the Gherkin in the city of London, that discussed how better communication delivers the most significant wins regarding productivity for small- to medium-sized businesses in the UK.

The session coincided with new research examining how SMBs can overcome stagnation in 2024. Of the many interesting findings, these were the most compelling for me: Poor management was the top internal barrier to growth, highlighted by over four in ten (45%). This was followed by: Poor communication and lack of collaboration (38%); Lack of motivation (36%); and Employee burnout (33%).

Clearly, whether working in the office or not, communication and collaboration go hand in hand, and these have to improve – for everyone’s sake, with the UK languishing at the bottom of the G7 productivity rankings.

As the roundtable chair, CEO of Be the Business Anthony Impey, noted, a 1% increase in the UK’s productivity will boost the economy by £95 billion over five years.

The past

Here come the badgers, finally.

This month, I enjoyed a weekend spa retreat in the New Forest, close to Lymington, where – ironically – the aforementioned Gibbons served as a member of parliament in the 1780s. I stayed five miles due north in Brockenhurst and enjoyed strolling in the countryside, marvelling at deer and wild horses. I was fascinated to learn the (alleged) etymology of Brockenhurst stems from the Celtic for “badger’s home” with the black-and-white nocturnal creatures having been common residents for centuries.

I was informed that the badgers have, over the years, built an underground tunnel that stretches from Brockenhurst to Lymington. Human attempts to block the way, and collapse the tunnel, have come to nought. The badgers are resilient and inventive, they will always dig around obstacles, and make new tunnels. It struck me that we should all be more like badgers.

Statistics of the month

- Only 8% of European businesses have adopted AI, whereas the number is over 50% in the United States, according to Cecilia Bonefeld-Dahl, Director General of DIGITALEUROPE.

- Cisco’s 2024 Data Privacy Benchmark Study shows more than one-quarter of organisations have banned the use of generative AI, highlighting the growing privacy concerns and the trust challenges facing organisations over their use of AI.

- O.C. Tanner’s 2024 Global Culture Report revealed that less than half of UK leaders (47%) consider their employees when deciding to enact business-wide changes. And just 44% seek employee opinions as changes are rolled out.

Stay fluxed – and get in touch! Let’s get fluxed together …

Thank you for reading Go Flux Yourself. Subscribe for free to receive this monthly newsletter straight to your inbox.

All feedback is welcome, via oliver@pickup.media. If you enjoyed reading, please consider sharing it via social media or email. Thank you.

And if you are interested in my writing, speaking and strategising services, you can find me on LinkedIn or email me using oliver@pickup.media.